Uprova 2025: All You Need To Know

Uprova is a rising name in the world of fintech, offering digital lending solutions tailored for individuals in need of short-term financial assistance. As of 2025, Uprova has expanded its offerings and grown in popularity for its commitment to fast, transparent, and accessible online loans. Designed with a strong focus on convenience and speed, Uprova aims to simplify the loan process for Americans who often face difficulties accessing traditional lending institutions.

What Makes Uprova Stand Out in 2025?

In a saturated market of digital lenders, Uprova distinguishes itself by combining technology, responsible lending, and customer-focused practices. In 2025, Uprova’s platform supports faster approvals, a wider range of loan amounts, and real-time bank verifications. The company has also implemented enhanced security protocols using blockchain-inspired encryption to safeguard borrower information.

Another critical aspect of Uprova’s edge is its commitment to education and financial literacy. Through blog posts, newsletters, and mobile app tips, Uprova helps users not just borrow, but also learn how to manage and repay responsibly.

Uprova Loan Types and Services

Uprova offers several financial products designed to meet different emergency needs. These include:

- Installment Loans: Repaid in fixed amounts over scheduled terms, ideal for customers who want predictable repayment plans.

- Personal Loans: Typically unsecured, these cater to larger amounts that cover expenses like medical bills or car repairs.

- Line of Credit (LOC): A revolving credit line that allows borrowers to draw as needed and repay over time.

In 2025, Uprova has expanded these offerings across more U.S. states, improving financial inclusion in underbanked communities.

Eligibility and Application Process

To qualify for a loan with Uprova in 2025, applicants must:

- Be at least 18 years old

- Have a valid government-issued ID

- Possess a consistent source of income

- Maintain an active checking account

The application process is fully digital and can be completed in minutes. Borrowers provide basic information, verify employment, and link their bank account using a secure API. Approval decisions are typically delivered within minutes, and funds can be deposited within 24 hours.

Interest Rates and Repayment Terms

Uprova’s interest rates vary by state and individual creditworthiness. As of 2025, APRs range from 36% to 199%, which, while high, are still competitive within the short-term lending space. The company is transparent about fees and repayment schedules, and offers tools for borrowers to preview their total loan cost before accepting terms.

Repayment periods vary between 3 to 24 months, depending on the loan type and amount. Early repayment is encouraged and comes with no penalty, giving borrowers flexibility and financial control.

Customer Experience and Reviews

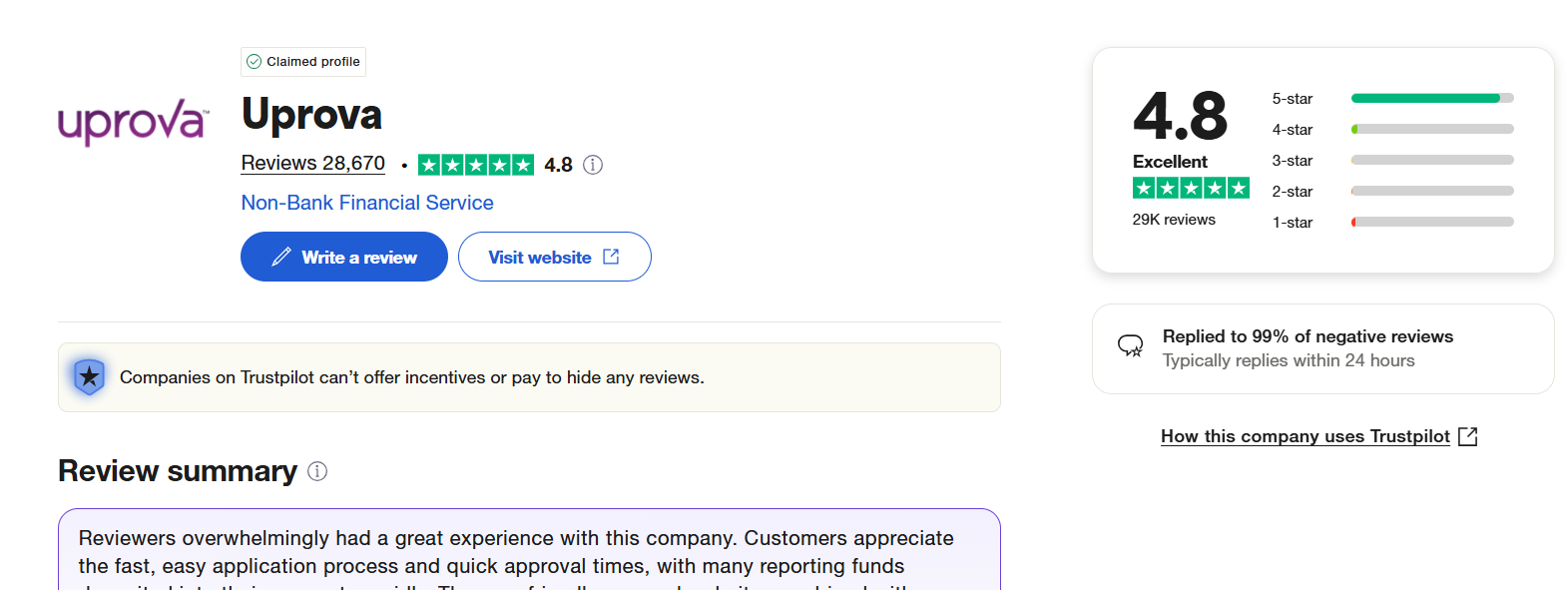

Customer satisfaction has been a driving force behind Uprova’s growth. On platforms such as Trustpilot and Better Business Bureau (BBB), Uprova maintains a solid rating, with many users praising the speed of approval, user-friendly interface, and transparent communication.

In 2025, Uprova has also introduced a 24/7 virtual assistant within its mobile app, offering real-time responses to frequently asked questions, loan status updates, and financial advice. This customer-first approach has resulted in strong retention and word-of-mouth referrals.

Uprova and Financial Inclusion

One of Uprova’s most notable contributions is its effort to promote financial inclusion. Many of its borrowers come from rural or underserved urban areas where traditional banking services are limited. Uprova’s ability to provide loans to individuals with poor or limited credit histories ensures that more Americans can access emergency funds without resorting to predatory lenders.

Additionally, Uprova reports positive repayment activity to major credit bureaus, allowing responsible borrowers to rebuild or improve their credit scores over time.

Regulatory Compliance and Transparency

Operating in a heavily regulated space, Uprova has taken steps in 2025 to reinforce its compliance with federal and state lending laws. It adheres strictly to the Truth in Lending Act (TILA), Fair Credit Reporting Act (FCRA), and other consumer protection policies.

All loan disclosures are clearly presented, and customers must electronically sign a contract before funds are disbursed. Uprova also undergoes routine audits and maintains a compliance team to monitor changes in the regulatory landscape.

Digital Tools and Mobile Integration

The Uprova mobile app, updated in early 2025, offers full-service functionality. Borrowers can apply for loans, make payments, view schedules, set reminders, and even chat with support directly through the app.

Its integration with budgeting tools and financial wellness calculators allows users to assess how loans impact their monthly finances. Additionally, Uprova leverages AI to recommend the best loan products based on user data, behavior, and repayment trends.

Alternatives to Uprova in 2025

While Uprova provides a reliable service, it’s important for borrowers to explore alternatives depending on their financial situation. Notable competitors in 2025 include:

- Upstart: AI-driven underwriting for personal loans.

- Earnin: Earned wage access without traditional interest.

- OppLoans: Subprime lending with flexible terms.

- Brigit: Credit builder tools and cash advances.

Each of these platforms has its own advantages, but Uprova stands out for its balance of speed, flexibility, and customer support.

Final Thoughts

Uprova 2025 is an appealing choice for those in need of quick, short-term financial relief—especially individuals who may not qualify for traditional bank loans. With a streamlined application process, helpful educational resources, and flexible loan terms, Uprova positions itself as a trustworthy and innovative lending partner.

However, as with all financial commitments, borrowers should assess their repayment ability and compare terms with other options. Uprova is best suited for emergency expenses and should not be used for long-term borrowing or unnecessary spending.